In recent years, India has seen the fury of powerful cyclones that have left a path of devastation in their path. Four-wheelers are among the dead since they are prone to going off course or seriously damaging vital parts like the engine, gearbox, and electric system.

Since repair prices might reach INR 2-3 Lakhs, auto insurance is an essential safety precaution.

We’ll lead you through the Automovill website insurance claim procedure for cyclone damage in this article.

Understanding Coverage

Owners of cars can exhale with peace in knowing that comprehensive auto insurance plans also cover losses resulting from earthquakes, floods, and cyclones. This comprehensive coverage includes both man-made and natural calamities.

Some of the events that are covered are:

● Damage from explosion or fire

● Theft and burglary

● Manmade calamities like vandalism and riots

● Natural calamities like cyclones, earthquakes, floods etc.

● Third-party liabilities

● Accidental damage

● Coverage from add-on covers like roadside assistance, zero depreciation, return to invoice etc.

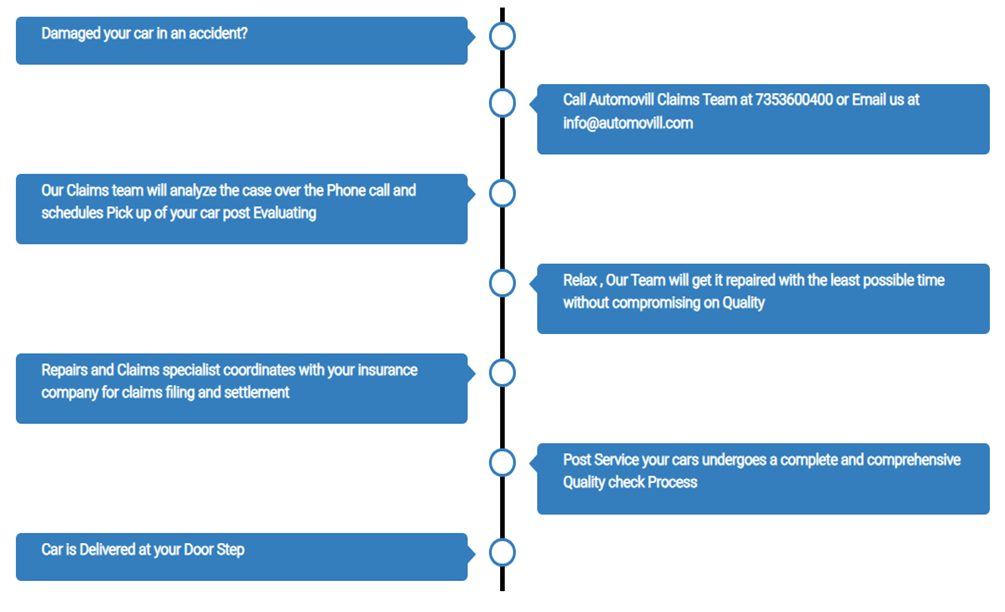

The Claim Process Unveiled

Why Automovill for Insurance Claims?

Streamlined claims process:

- 24/7 support: You can initiate your claim anytime through their phone hotline or app.

- Fast settlement: Settling claims in under 10 days in some cases, potentially faster than traditional channels.

- Cashless claims: We have partnered with a network of garages across India, eliminating the need for upfront payments and the hassle of reimbursements.

- Remote claim initiation: You can initiate claims through photos and videos, avoiding the need for immediate physical inspection in potentially unsafe areas after a cyclone.

Additional benefits:

- Transparent pricing: We provide clear estimates upfront to avoid hidden costs or surprises.

- Quality repairs: They use reputed and authorized workshops with standardized repair processes.

- Convenience: They offer pick-up and drop services for your car, minimizing your post-cyclone burden.

- Additional services: Some offers include free car services, paint warranties, and extended warranties on repairs, adding value to your experience.

Conclusion

While dealing with a cyclone’s aftermath can be extremely stressful, having comprehensive auto insurance offers protection against expensive repair bills.

You can handle the procedure with confidence, guaranteeing a prompt settlement and getting back on the road sooner, if you are aware of the stages involved in making a claim for cyclone damage.

With Automovill Car Insurance Claim Service, be prepared and safe.